Upstox App

| Upstox is online trading platform where people can choose to invest in Stocks, IPOs, Mutual Funds and Future & Options. You need to open your account with Upstox before trading here. Account Opening is very easy and fast process. If you are also looking for the best app to trade online then you must Download Upstox from below given button. |

DetailsUpstox is an online trading platform that allows users to trade in various financial instruments such as stocks, derivatives, commodities, and currencies. It is one of the popular stock broking platforms in India. Upstox offers a mobile application called the Upstox app, which is available for both Android and iOS devices. The app provides users with a convenient way to trade on the go, access market data, place orders, and manage their portfolio ReviewsThese reviews are from Upstox App users who are using Upstox Since Long time. Consider these reviews for choosing Upstox as your Trading App. 1) Ishita Chauhan Ratings – 4.6 The ROS feature is very good and can help the budding option traders to learn with proper discipline and risk management. like the Chart offered by Upstox, the Candles in the Chart are very clear to view. 2) VikramJeet Singh Ratings – 4.8 Upstox is one of the best app is one of the best app I have ever used for online trading. I ma used many other apps but to be honest Upstox has proved to be best for me till now. I would like to suggest it for trading. 3) Ramesh Kapoor Ratings – 4.6 Upstox is really very simple to use app where anybody can learn how to trade easily and earn money daily. I would like to suggest that everyone must use Upstox app. One of the prominent feature of the app is it’s security. VersionsAs we know these apps keep on updating and every new updated version has some improvements and advanced features which may lack in your previous App Version. Here is the link to download the latest version of Upstox. So Current Version of Upstox APK is 3.26.11. You can download it and install it in your device. Once you download this version it will automatically transfer your Old data and trades in new app. This is 100 percent secure and official App provided by Upstox itself. Information

|

Uptsox APK Download

Upstox App is available for both Android and iOS software. You can first download it’s APK version from here and then you can install it in your device. Here you will get the Latest APK Version of Upstox that is v6.7.3 . There are more than 10 Millions downloads of Upstox APK. This APK file is safe and genuine provided by the official Upstox App. Upstox APK has file size of 22MB which is quite low and will not use much of your Storage. If you download Upstox App from here you will get Rs 500 Free as Sign Up Bonus which you can use to trade in Stocks and Shares. |

Open Upstox Demat Account

| As Upstox app is trading app approved by SEBI so before buying or selling stocks on Upstox you need to register yourself first on Upstox App. Once you complete the registration part you, you application will be reviewed by Upstox Team. Your accounted will be activated within 24 hours if the all the details are filled correctly by you. You can click on the above button to submit Upstox Account Application. You can follow below instructions to register on Upstox App successfully.

|

Upstox App Features

With growing technology, people are using many online apps for trading and also for other reasons. In present scenario there are multiple apps which provide platform for trading in Stocks, IPOs and Future & Options. But you should choose best out of everything. First you need to look for all the features of the App so that you can make your decision better. Here we have listed all the Upstox features so that you can chose the right app.

|

Upstox App Charges

Before Choosing any Trading App, everyone looks for the brokerage charges per executed trade. So here we have provided the detailed charges charges by Upstox App. You can compare them with other trading platform before selecting it. 1) Upstox Charges Rs 0 brokerage on Mutual Funds and IPOs. 2) Upstox Charges Rs 20 or 0.05% (which is lower) on Equity Trading, F&O, Currency & Commodity Trading. 3) Upstox Charges Rs 20 or 2.5% (Which is lower) per order on Stocks. |

Upstox Brokerage Calculator

Upstox Provide the calculator so that you can personally calculate the Brokerage on your selected trading amount. You can select any stock or commodity in which you want invest you money. You can follow the below steps to calculate brokerage.

|

Upstox App For PC

| Many of the Users use this App in Laptops and PC for their Convenience. As watchlist is more clearly visible On Big Screen and also executing trades on Laptop and PC is much more easy and comfortable. So Upstox provides the facility of operating Upstox on PC also. You can download Upstox App on your personal computer and use it as Mobile Device. |

Upstox App: How to Use?

Now We will explain you in detail How Upstox App works. We will discuss every of it’s feature in detail. These all the functions are very much vital for everyone who is using Upstox App. So read about these functions to become Upstox App experts. Upstox App WatchlistWatchlist is the sheet in which you can find the live price of all the shares, Commodity, F & O. These live price changes every seconds and minutes. Watchlist has it’s own very important use as you buy or sell trades on the basis of watchlist. By default you have 20 shares price is shown in watchlist. You can add more by Clicking Plus button or you can remove any share price. Upstox Orders

In this section you will find the Orders you have done in Upstox App. Here you will see three types of orders, All, Open and Closed. In All order you will find all the order so far you have placed. In Open section, it contains orders which are still going and Closed section contains orders which are completed. You need to check this section regularly so that you did not miss any trade. Upstox Portfolio

An investment portfolio refers to a collection of financial assets owned by an individual, organization, or entity. These assets are typically acquired with the intention of generating a return on investment over time. Investment portfolios can include a wide range of assets, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, commodities, and alternative investments like private equity or hedge funds. The purpose of constructing an investment portfolio is to diversify holdings and spread risk across different asset classes. Diversification helps reduce the impact of potential losses from any single investment and can potentially enhance overall returns. Investment portfolios are tailored to meet specific financial goals and risk tolerances. Some common goals include wealth accumulation, retirement planning, saving for education expenses, or funding a particular lifestyle. Each individual or entity may have different investment objectives, time horizons, and risk appetites, which influence the composition of their portfolio. Portfolio management involves making informed decisions regarding asset allocation, which refers to the distribution of investments across different asset classes. This allocation is based on factors such as the investor’s risk tolerance, investment time horizon, and market conditions. Periodic monitoring and rebalancing of the portfolio may be necessary to maintain the desired asset allocation and adjust for changes in investment performance or market conditions. It’s important to note that constructing and managing an investment portfolio requires careful consideration and often benefits from the guidance of a financial advisor or investment professional. They can provide expertise and assist in creating a portfolio that aligns with your financial goals and risk tolerance. Upstox Funds

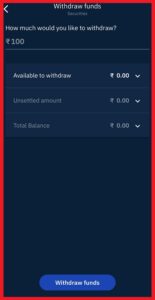

This section of Upstox is most important to understand clearly so that you did not commit any mistake while dealing with funds. In this section of the Upstox App you can Add Funds, Withdraw Funds and view payment history. First we will discuss how you can Add Funds to your upstox account. Here are all the necessary steps to add funds securely. How to Add Funds? Step 1) Click on the Add Funds Step 2) Now Enter the Amount of Funds you want to Add Step 3) Now Choose Your Linked Bank Account Step 4) Now You have to select Payment Mode – UPI/Net Banking/NEFT/RTGS/IMPS Step 5) Click On Continue Button and Open Up Your Payment method which you have selected. Step 6) Funds will safely credited to your Upstox Account. How to Withdraw Funds?Now you know how you can add funds in Upstox Account. Suppose that after this you have placed your trades and you have made some profit. Then you need to withdraw that profit in your bank account. Here are some vital steps to release funds in your account.

Step 1) Click On Withdraw Button in Funds Section Step 2) Now Enter the Amount You want to withdraw. Step 3) You can only withdraw Amount which is shown in ‘Available to Withdraw‘ to Option. Step 4) Now Click On Withdraw Funds Button There are few more option in Funds section which are also important for you to understand. So here we have briefly explained them. Available To Trade : This is the Total amount that you have available to trade at the moment. Used Margin: This is the total Amount that you have utilised, against any open or closed positions. Total Margin : This is the sum of the amount available to trade and the amount of used funds. |

How to Place Trades in Upstox App?

This query is of immense use as Upstox is meant only for placing trades in any segment like, F & O, Commodity, Shares or IPOs. Placing trades can be confusing for the new users as three steps are involved in Placing a trade. In case of confusion or doubt, you can just follow the below steps. Step 1) First Select the Share or Stock in which you want to invest money. Step 2) Now Search that in Watchlist Section Step 3) Now Click on that Share Step 4) You will See Two Option at the Bottom Of the App Buy or Sell Step 5) Select Buy or Sell Option on the basis of your Interest Step 6) Select the Product Type, Delivery or Intraday Step 7) Enter the Quantity, Order Type Step 8) Click On Review Order and Confirm Order After this process, your order will be visible in Orders Section. You should keep an eye on Bought or Sold Share so that when price goes up or down, you can make the profit. Once you get the desired price of your stock you can exit the trade from order section. If you have bought then at the time of execution, you have to sell stock. |

Upstox App Refer & Earn

Along with Investment Upstox provides best method of earning money without investing money. This method is 100 percent working and authenticate way of earning money. In this method registered user needs to share this app with other people and if they open Demat Account then you will get Rs 300 and when your invitee start investing then you will get Rs 250 More. You can follow below steps to Refer and Earn with Upstox. Step 1) Click on the profile section in Top Left Corner of the App Step 2) Now Select Refer & Earn Step 3) Now Copy The link and share it with others Step 4) Once someone register on Upstox with your link, you will get commission Step 5) You can see your invitees in “Your Earnings & Referrals” Section Note: To Increase your referrals, you can share your affiliate link with people on different social media platforms. |

Upstox App : FAQs

Q. Is Upstox Safe or Not?

Upstox is highly safe and secure platform on investing in Shares, Stocks, F & O and Mutuals Funds. This is regulated and reviewed by SEBI( Securities and Exchange Board of India)

Q. Is Uptsox Owned by TATA Group?

Upstox is Owned By TATA group and Tiger Global which is Investment Management Company.

Q. Is Upstox Better than Zerodha?

Both Zerodha and Upstox are most preferred trading platforms and their demand in the market has grown enormously in Trading World. But if you have to choose one then, Upstox is Better than Zerodhan in terms of brokerage fee charged by both.

Q. Is Uptsox Real of fake?

Upstox is real and genuine app which provides facility to trade in many segments like Stocks, Shares, Commodity, Future & Options and Mutual Funds.

Q. Is Upstox Free?

Opening demat account with Upstox is free and it didn’t charge any fee. But you have to pay brokerage at the time of investment which differs accordingly.

Q. Is Upstox Good for Beginners?

Upstox has very simple and user friendly interface and placing trades is made easier. So Upstox is definitely best for beginners. You also get customer support in your initial days.

Q. How Old Is Upstox?

Upstox was founded in 2009 but it was in Physical Mode. Later in 2018 It Launched it’s digital platform and then grown up to 14 Million Users Per Month.

Q. How much Upstox Charges?

- Upstox Charges Rs 0 brokerage on Mutual Funds and IPOs.

- Upstox Charges Rs 20 or 0.05% (which is lower) on Equity Trading, F&O, Currency & Commodity Trading.

- Upstox Charges Rs 20 or 2.5% (Which is lower) per order on Stocks.

Q. How do I Download Upstox App ?

You can download Upstox App from Play Store or App Store for Android as well as iOS devices. You can also download it’s APK version from upstoxapk.com and then Install it in your device.

Q. Can I download Upstox App in Laptop ?

If your Laptop has Windows 11 Installed in it or your are using Mac Book then you can easily download Upstox App in Laptop.

Q. Which is the Correct Upstox App ?

Upstox has two apps one is Upstox and other is Upstox (New) Pro. You can download anyone of them as per your choice but Upstox New Pro app then you get more features as compare to Old Upstox App.

Q. Which is best Upstox or Zerodha ?

Upstox and Zerodha both are brokers where people can buy and sold shares. But if we compare both of them then Zerodha is much older than Upstox hence more reliable, Zerodha has more users than Upstox and Zerodha Charges are very much less than Upstox. So Zerodha better than Upstox as per trading aspects.

Q. Which bank is best for Upstox ?

In terms of trading in shares then HDFC, Punjab National Bank, IDFC, ICICI and Axis bank are best among other banks.

Q. Is Upstox in Profit ?

Upstox witnessed a significant growth in operating revenue, surpassing 40 percent and reaching Rs 1,000 crore. Furthermore, in the last quarter of FY2022-23, the company achieved a positive net cash flow of around Rs 130 crore. With cash reserves exceeding Rs 1,000 crore, Upstox is actively seeking opportunities for expansion through both organic and inorganic means.

Q. Who is the Owner of Upstox ?

Upstox is owned by three people Ravi Kumar (Co-founder & CEO), Kavitha Subramanian (Co-founder) and Shrini Viswanath (Co-founder) but funded by TATA Groups.

Q. What is the Minimum Amount in Upstox ?

When you Open Your Demat Account, you don’t need to maintain any minimum balance in Your Account.

Q. What is the Minimum investment in Upstox App ?

When you Open you demat account, you need to Add Funds to your account to invest. But you cannot deposit less than Rs 200 in your account.

Q. Which is No. 1 Trading account in India ?

In terms of Number of Active Investors in India, Zerodha has top the list followed by Angel One, Upstox, ICICIDirect and Groww.

Q. What is the Account Opening Fee in Upstox ?

In present time Upstox Charges Rs 0 for opening demat account, so basically you can open account free of cost.

Q. Which is the safest Demat Account ?

Zerodha and Upstox stand out as the most renowned and dependable Demat account providers in India, earning widespread popularity and trust.

Q. How I can buy or sell shares ?

To Buy/ Sell Shares you need a SEBI authorized and registered broker. It can be Zerodha, Upstox, Angel One, Groww, 5 Paisa or ICICIDirect. You need to open your demat account in any one of them and then you can add funds to invest in shares.

Q. How many People Use Upstox ?

As per the report published by Money Control, Upstox has got 10 Million active users out of 90 Million Investors in India.